While sold prices have held steady over the past few months, Markham house prices have certainly skyrocketed by record amounts as compared to last year… but for how long?

The government recently introduced new mortgage rules and tax laws aimed at slowing the housing market down. There are several aspects to these changes and I’ll sum them up for you.

First, it is going to become much harder for Canadians to qualify for a new mortgage as all buyers, including both high and low ratio borrowers, will have to qualify at the posted rate with a maximum 25 year amortization. On average, this is expected to reduce a prospective buyer’s purchasing power by about 20%.

Second, the government is closing a tax loop hole for foreign buyers who buy Canadian properties but don’t live in them as their principal residence. Apparently, many foreign buyers have been claiming their Canadian investments as their primary residence in order to avoid paying capital gains tax when they eventually sell the home.

The last change, which has not actually happened yet but is currently being considered involves lenders sharing in the risk of insured mortgage when a homeowner defaults on their loan. Currently, the banks have no skin in the game and the government is considering having the banks pay a deductible when someone defaults on their mortgage. If this happens, it’s most likely that the banks will pass on this cost to consumers in the form of higher interest rates.

So will these changes make a difference? I think so. Demand will certainly drop as many first time buyers and some “move up” buyers won’t be able to qualify for a home they want. Though the real question will be, how will this affect supply. Will we see a surge of listing from homeowners feeling like they want to cash out before a potential drop in price? or will most people choose to stay put for a while because they want to see what happens with the market first or simple can’t qualify for a mortgage they want?

Time will certainly tell, but in the mean time, prices remain high, homes have been selling quickly (still multiples offers everywhere) but total inventory has started to increase as compared to the number of sales. Check out the latest sales statistics for Markham below.

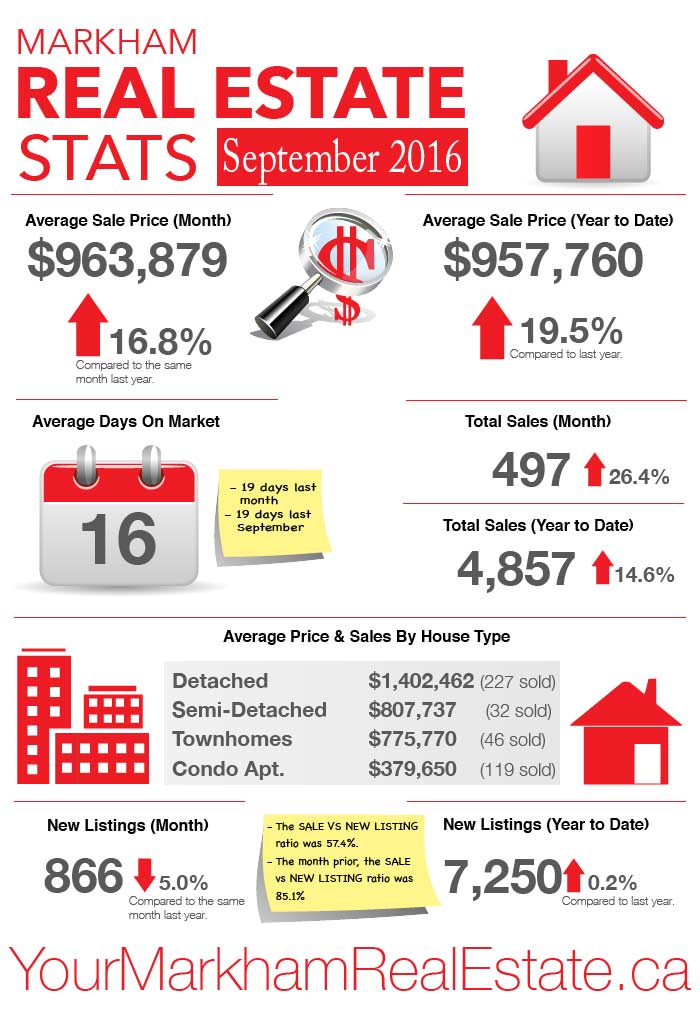

Markham Real Estate Sold Statistics During September 2016

- The average sale price in September was $963,879. Up 16.8% over the same month last year.

- The average sale price to date this year is $957,760. Up 19.5% over last year.

- The average time it took for a house to sell was 16 days compared to 19 days the month prior and 19 days last September.

- There were 497 total sales last month. Up 26.4% over the same period last year.

- So far this year, we have seen 4,362 sales. That’s up 14.6% over the same timeframe from last year.

- There were 866 new listings last month. That’s a decrease of 5% and a sale to new listing ratio of 57.4%

- The month prior, the sale to new listing ratio was 85.1%

- So far this year, new listings are up 0.2% over the same timeframe from last year.

- The average sold price for detached homes last month was $1,402,462with 227 homes sold.

- The average sold price for semi-detached homes last month was $807,737 with 32 homes sold.

- The average sold price for townhomes last month was $775,770 with 46 homes sold.

- The average sold price for condo apartments last month was $379,650 with 119 units sold.

If you’re planning to make a move, contact me anytime! To get a quick idea of your home’s value, please visit my online evaluation page.

Leave a Reply