April was an interesting month for the real estate market in Markham and surrounding areas. The month pretty much started the way March ended…on fire! But on April 20th, the Ontario government announced a host of new measures to attempt to cool the red hot real estate market. There were a long list of changes but most notably, a 15% foreign buyers tax was introduced, similar to what was introduced in Vancouver last year.

It’s impossible to predict the long term effects these new rules may have on the market, but at least over the past couple of weeks, a change has been evident. While prices are still way up, they didn’t change much from the month prior and keep in mind that the first half of April was red hot. Depending on how a property is priced, bidding wars have started to slow down, sales have dropped and our inventory is finally on the rise….although relatively speaking, it’s still quite low.

Personally, I feel like these new measures were less drastic then the new mortgage rules that took effect late last year and the market still exploded. There’s a very real possibility that many people have shifted to a “wait and see” mode to see how these changes will effect the market. It’s no surprise that things have begun to cool a bit but the real questions is “is this short-term or will it last?”

The Toronto Real Estate Board recently hired a research company to estimate the percentage of foreign buyers in play in our market and found the number to be quite low. But apparently the survey included many areas not greatly affected by foreign buyers and also, did not take into account resident buyers or students that may be receiving funds from overseas. When the same tax was introduced in Vancouver last summer, the market definitely slowed down as their percentage of foreign buyers was thought to be much higher than here in the GTA although those effects seemed to have been short lived as prices have reportedly begun to rise again.

The real issue, I think, is supply. While we may be finally starting to see more listings hit the market, overall, inventory is still quite low and this will likely be the main driver to the long term picture. While things have definitely shifted, if supply continues to increase, it will still likely take a few more months for the market to balance out based on the large accumulated demand built-up over the past year or two.

If I had to guess, I would think that home prices in Markham will remain fairly steady or increase slightly throughout the rest of the year. We’ll probably see some up and down movement from month to month but the trend will likely remain stable but I think it’s only a matter of time before things heat up again. The question is…how much time?

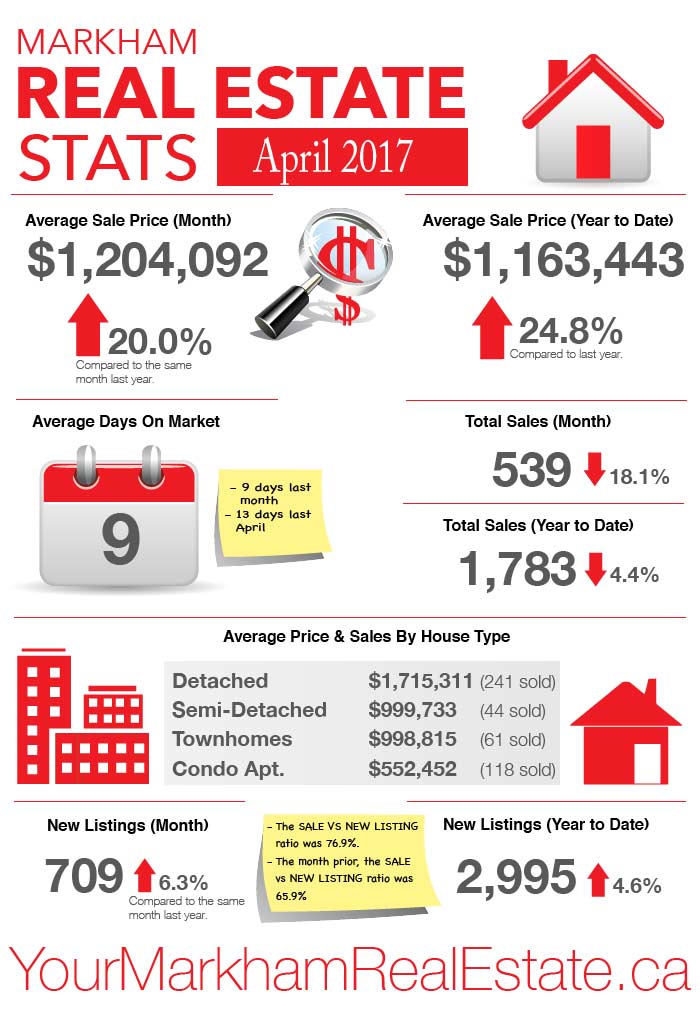

Check out the latest real estate statistics in Markham from April 2017 below.

Markham Real Estate Sold Statistics During April 2017

- The average sale price in April 2017 was $1,204,092. Up 20% over the same month last year.

- The average sale price to date this year is $1,163,443. Up 24.8% over last year.

- The average time it took for a house to sell was 9 days compared to 9 days the month prior and 13 days last April.

- There were 539 total sales last month. Down 18.1% over the same period last year.

- There were 709 new listings last month. That’s an increase of 6.3% and a sale to new listing ratio of 76.9%

- The month prior, the sale to new listing ratio was 65.9%.

- The average sold price for detached homes last month was $1,715,311 with 241 homes sold.

- The average sold price for semi-detached homes last month was $999,733 with 44 homes sold.

- The average sold price for townhomes last month was $998,815 with 61 homes sold.

- The average sold price for condo apartments last month was $552,452 with 118 units sold.

If you’re planning to make a move, contact me anytime! To get a quick idea of your home’s value, please visit my online evaluation page.

Leave a Reply