First-Time Home Buyers

Are you thinking about buying your first home? Not sure how it all works? Don’t know which neighbourhood is right for you? If you answered yes to any of these questions and you are considering buying a home in Markham, Unionville, Stouffville or any surrounding areas, you’ll find the following information very helpful. Martin MacFarlane is a local Markham real estate agent and he wants you to be well informed before you make the biggest decision of your life.

There is so much information you should be aware of when buying your 1st home in Markham and surrounding areas. There are also many real estate agents in Markham that you could choose from to help you with your purchase, but Martin MacFarlane specializes in the Markham area and working with first-time homebuyers. He regularly inspects agent open houses every week and is always on top of the latest inventory.

Markham, Unionville and Stouffville all have great opportunities for first-time home buyers depending on your lifestyle and budget. In Markham, there are many newer neighbourhoods such as Cornell which is made up of four sections: Upper Cornell, Cornell Village, Grand Cornell and Cornell Rouge. All of these neighbourhoods are located East of 9th Line. There is also a great neighbourhood known as Greensborough located North of 16th Avenue between Markham Rd and 9th Line. Depending on your budget, there are many great opportunities for first-time homebuyers to break into the real estate market. The most common types of homes you will encounter include stacked townhouses, condo townhomes, condominiums, freehold townhouses, semi-detached and detached homes.

Stouffville has also been very popular with first-time homebuyers and young families as the population has grown very quickly in the last few years. Stouffville is located just North of Markham and offers many newly built homes at a slightly lower cost. Stouffville has been considered by many to be one of the best investment opportunities in Ontario over the next 5 years. Homeowners who live in Stouffville enjoy a “country in the city” type of lifestyle.

There are many great pockets to live in within these neighbourhoods and one of the best things you could do is to drive the streets yourself and get a personal feel for the areas on your own. Of course your best “first move” would be to secure the knowledge of a Realtor who is local to your preferred location. For example, real estate agents in Markham will have better knowledge of the schools, transportation, activities and house prices in Markham than real estate agents who works in Toronto.

How Much Can I Afford?

Knowing how much you can afford to spend on your first home is extremely important to know before you start looking. The last thing you want is to fall in love with the perfect home, only to find out that you can’t afford it. You should always obtain a pre-approval from a mortgage lender before you begin viewing homes. Knowing how much you can spend will help you narrow in on the best homes that suit your needs. It will also improve your chances of getting your offer accepted by the home sellers.

The most widely used calculation for determining how much you can afford is known as your Gross Debt Service (GDS) ratio. This basically means that your housing costs shouldn’t be more than 32% of your gross household monthly income. Housing costs include the principal and interest of your mortgage payment, annual property taxes as well as heating expenses. If you plan to buy a condo, it will also include half of your monthly maintenance fees. You can use a mortgage calculator to give you a better idea of what you can afford before you attempt to obtain a pre-approval.

Another Calculation your lender will consider is you Total Debt Service (TDS) ratio. This basically means that your entire monthly debt load shouldn’t be more than 40% of your gross monthly income. This includes all the housing costs in you GDS plus other debts such as car loans and credit card payments.

Down Payments and Mortgage Insurance

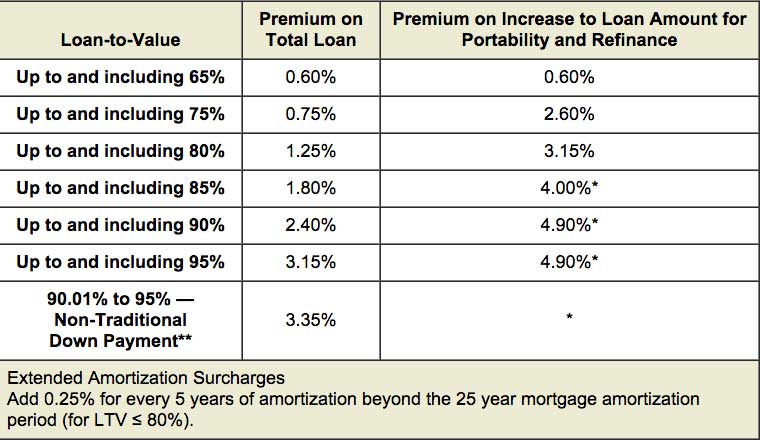

The minimum down payment required to obtain a conventional mortgage is 5% but the more you have to put down, the better. Home buyers who have less than 20% of the purchase price as a down payment will have to obtain mortgage loan insurance from companies such as Canada Mortgage and Housing Corporation (CMHC) or Genworth Financial. The following table is taken from the CMHC website and provides the insurance rates depending on your loan-to-value ratio and amortization.

Closing costs

In addition to having enough money for a down payment, you’ll want to make sure you have enough money to cover your closing costs and you’ll probably want to furnish your home as well. Closing costs will vary from home to home but you should expect anything from 2% to 4% of the purchase price. Your lender will also want to see that you are able to cover all related costs involved. The following will give you a rough breakdown of what you can expect to pay.

- Deposit: This amount is negotiable but 5% is typical. The deposit is usually submitted with an offer to purchase and forms part of your down payment to be paid at closing.

- Legal Fees: You lawyer will cost you about $1000 to $2000.

- Appraisal Fee: Your mortgage lender might require an appraisal of the property at your expense which would normally cost between $250 to $350.

- Mortgage Loan Insurance: If your total down payment is less than 20% of the purchase price, your mortgage will be considered high ratio. Your premiums will depend upon your loan-to-value ratio and may be added to your mortgage in most cases.

- Land Transfer Tax: A pre-determined percentage of your purchase price. First-time home buyer are usually entitled to a partial refund up to $2,000. Please use a land transfer tax calculator to determine your costs. If you are a first-time buyer your lawyer will usually take care of the rebate on your behalf.

- Adjustments: Your lawyer will make adjustments on your closing statement in regards to mortgage interest or taxes and utilities that may have been pre-paid by the sellers.

- Home Inspection: It is normally recommended that you hire a certified home inspector to inspect your home as a condition forming part of your offer to purchase. This will cost you $300 to $500.

- Title Insurance: Your lawyer will arrange this which protects you from any defects to the title of the property and will cost approximately $350.

- Survey: Your lender may require you to provide an up-to-date survey and if you cannot get one from the seller, you might have to pay $1,000 to $2,000 for one. Although in most cases, title insurance will suffice.

- Status Certificate: You might be require to pay up to $100 for a status certificate if you are purchasing a condominium.

Other Home Ownership Costs

- Home Insurance: You will also be required to purchase a home insurance policy which will cover the cost of replacing your home and its contents.

- Property Tax: Amounts will vary but you should expect about 1% of your home’s appraised value (annually).

- Appliances: Depending on what comes with the property.

- Window Treatments: Many first-time homebuyers can overlook this cost if they are not included with the house.

- Service Connection Fees: You will usually incur extra charges for setting up your cable, telephone, gas, electricity and other various utilities.

- Condominium Fees: If you are purchasing a condominium you will have monthly maintenance fees to pay.

- Moving Expenses: Will vary depending on distance, size of truck and whether or not you hire a company to do it for you.

- Miscellaneous Expenses: You should also expect many more miscellaneous expenses such as decorating, gardening equipment, snow-clearing equipment, tools, repairs, etc.

As you can see, there are many expenses involved when buying a home in Markham, Unionville, Stouffville or anywhere in Ontario for that matter. And these costs are not listed here in an attempt to scare you, but rather to help you become better prepared. The advantages of homeownership far outweight its disadvantages. After all, you’re putting money back in your own pocket, which is surely better than throwing it all away to rent. Apart from all these costs, there are certain government programs that you should be aware of.

Home Buyers’ Tax Credit (HBTC)

As of January 27, 2009 qualified home buyers are eligible to claim $5,000 for the Home Buyers’ Tax Credit on their personal tax returns. To qualify for this amount, the closing date for your home must be after January 27, 2009 and you (and your spouse or common-law partner) must be first-time home buyers. For more specific information visit the Canada revenue website.

Home Buyers’ Plan

The homebuyer’s plan allows first-time homebuyers the opportunity to withdraw up to $35,000 from their Registered Retirement Savings Plan (RRSP) to purchase a qualifying home. Your RRSP contribution must remain in your account for a minimum of 90 days before being withdrawn. Generally, you must begin repaying the funds the second year after your withdraw them. You will have 15 years to pay it back with 1/15th being due each year. If you fail to repay any amount for a specific year, that amount will be added to your income.

H.S.T. On New And Resale Homes

Many home buyers are still confused about how the new HST applies to the purchase of your home. If you are buying a resale home (not a brand new home from a builder) your purchase is NOT subject to HST. That’s right, you are completely exempt from HST.

It’s a little more complicated if you are buying a new home directly from the builder. If you are purchasing a new home under $350,000 before tax, you are entitled to a 36% rebate of the GST portion of the tax up to a maximum of $6,300. If you are buying a home between $350,000 and $450,000 your GST portion of the rebate would be reduced on a proportional scale. If the home you want to buy costs more than $450,000 before tax, you would not be entitled to a rebate.

First-time home buyers can apply for a 75% rebate of the PST portion of the HST up to a maximum of $24,000. It may all sound a little confusing but the important area to note is that there is no HST applied to resale homes.

If you have any questions regarding HST, buying your 1st home in Markham or surrounding areas, closing costs or anything to do with real estate, please feel free to contact Martin MacFarlane. He’s here to help!